Taking control of your finances can seem overwhelming, but with the right tools and strategies, you can master your personal finances. The envelope budgeting system is a simple yet effective way to manage your money, and with these envelope budgeting system tips, you’ll be on your way to financial freedom. By using the envelope system, you can categorize your expenses and allocate your income accordingly, making it easier to stick to your budget.

Mastering your budget is achievable, and it starts with understanding how to use the envelope system effectively. With the envelope budgeting system, you can take control of your finances and make conscious spending decisions. By following these envelope budgeting system tips, you’ll be able to create a budget that works for you, not against you, and start building a stronger financial future. By using the envelope system to master your personal finances, you’ll be able to achieve financial stability and security.

Understanding the Envelope Budgeting System Basics

The envelope budgeting system is a simple, yet effective way to manage your finances. To understand how to use the cash envelope system, it’s essential to grasp its core principles. This system has been around for decades, providing a straightforward approach to allocating funds and tracking expenses.

At its core, the envelope system is based on dividing your expenses into categories and assigning a specific amount of cash to each category. This approach helps you stick to your budget and avoid overspending. By using the cash envelope system, you can develop effective money management methods that suit your lifestyle and financial goals.

To get started, you’ll need to identify your spending categories and assign a budget to each one. This can include categories like groceries, entertainment, and transportation. Once you have your categories, you can begin allocating funds and using the envelope system to track your expenses.

What is the Envelope System?

The envelope system is a budgeting method that involves dividing your expenses into categories and using cash to track your spending. This approach helps you avoid overspending and stay within your means.

Historical Background of Cash Envelope Budgeting

The cash envelope system has been around for decades, providing a simple and effective way to manage finances. By understanding the historical background of this system, you can appreciate its value and effectiveness in modern times.

Core Principles of the System

The core principles of the envelope system include dividing expenses into categories, assigning a budget to each category, and using cash to track spending. By following these principles, you can develop effective money management methods and achieve your financial goals.

Benefits of Using Cash Envelopes for Budgeting

Using cash envelopes for budgeting can have a significant impact on your financial situation. By implementing this system, you can master your personal finances and develop effective budgeting strategies for saving money. One of the primary benefits is increased financial awareness, as you are forced to physically handle cash and make conscious decisions about how to allocate your funds.

This approach can also lead to reduced overspending, as you can see the money dwindling in each envelope, making it more difficult to justify unnecessary purchases. Additionally, the envelope system promotes improved saving habits, as you are more likely to prioritize saving when you can see the cash accumulating in your envelopes.

- Reduced debt: By prioritizing needs over wants and making conscious spending decisions, you can reduce your debt and work towards financial freedom.

- Increased savings: The envelope system encourages you to save by allocating a specific amount of cash for savings each month.

- Improved financial discipline: The physical act of handling cash and making budgeting decisions can help you develop greater financial discipline and responsibility.

By incorporating the envelope system into your budgeting strategy, you can master your personal finances and develop effective budgeting strategies for saving money. This approach can have a lasting impact on your financial situation, helping you achieve long-term financial stability and security.

Essential Supplies for Starting Your Envelope System

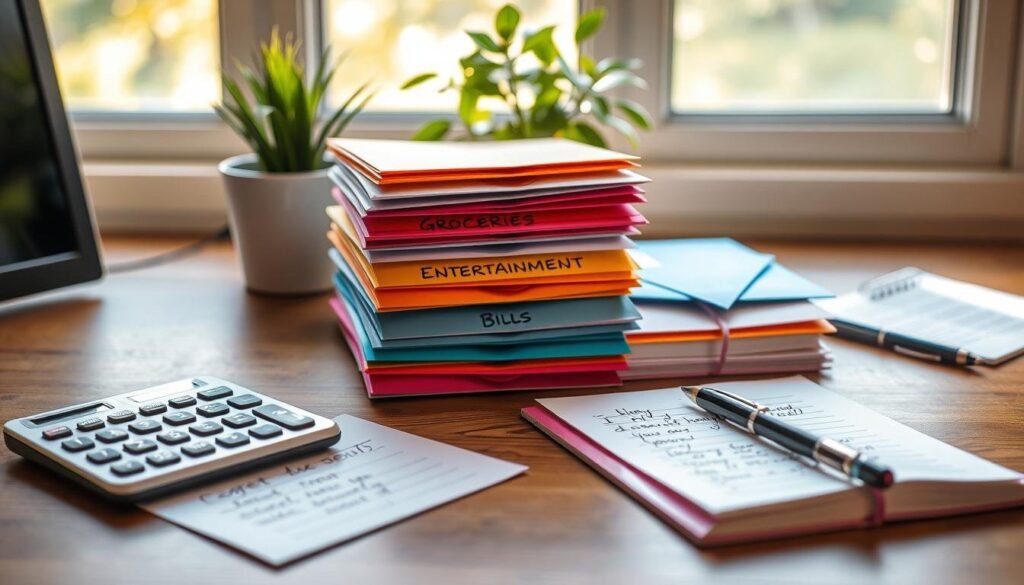

To begin using the envelope budgeting system, you’ll need a few essential supplies. These will help you stay organized and make the most of your budget. When it comes to envelope budgeting system tips, having the right tools is crucial. One of the most important supplies is a set of envelopes, which will be used to categorize your expenses.

Choosing the right envelopes is key. You’ll want to select envelopes that are sturdy and easy to label. This will make it simple to identify which envelope corresponds to which expense category. Consider using envelopes with a secure closure to prevent cash from falling out. By following these envelope budgeting system tips, you’ll be well on your way to managing your finances effectively. Here is a few to get you started:

Choosing the Right Envelopes

When selecting envelopes, consider the size and material. You’ll want envelopes that are large enough to hold your cash and receipts, but not so large that they become cumbersome. Look for envelopes made from durable materials, such as paper or cardboard. By using the cash envelope system, you’ll be able to track your expenses and stay within your budget.

Organizing Tools and Materials

In addition to envelopes, you’ll need some basic organizing tools and materials. A label maker can be helpful for labeling your envelopes, while a calculator can assist with tracking your expenses. You may also want to consider using a budget planning worksheet to help you allocate your funds. By following these steps and using the cash envelope system, you’ll be able to take control of your finances and achieve your goals.

Creating Your Spending Categories

To effectively manage your finances, it’s essential to establish spending categories that align with your financial goals and needs. Effective money management methods involve identifying areas where you can cut back on unnecessary expenses and allocate funds to more critical categories. By doing so, you’ll be able to implement budgeting strategies for saving money and achieve a better financial balance.

When creating your spending categories, consider the 50/30/20 rule as a guideline. Allocate 50% of your income towards necessary expenses like rent, utilities, and groceries. Use 30% for discretionary spending, such as entertainment and hobbies. The remaining 20% should go towards saving and debt repayment. This rule can serve as a foundation for your budgeting strategies for saving money.

Some common spending categories to consider include:

- Housing and utilities

- Transportation

- Food and dining

- Entertainment and leisure

- Health and wellness

- Debt repayment and savings

By implementing effective money management methods and budgeting strategies for saving money, you’ll be able to take control of your finances and make progress towards your financial goals. Remember to regularly review and adjust your spending categories to ensure they continue to align with your changing needs and priorities.

Setting Up Your Monthly Finance Goals

To master your personal finances, it’s essential to set realistic and achievable monthly financial goals. This process involves understanding your spending habits, income, and expenses. By doing so, you’ll be able to allocate your resources effectively, making the most of your money. The envelope budgeting system tips can help you prioritize your expenses and stay on track.

When setting up your monthly finance goals, consider the following steps:

- Determine your fixed expenses, such as rent, utilities, and groceries.

- Allocate your variable expenses, like entertainment and hobbies.

- Plan for emergency funds to cover unexpected expenses.

By following these steps and using the envelope budgeting system tips, you’ll be able to master your personal finances and achieve financial stability. Remember to review and adjust your goals regularly to ensure you’re on track to meeting your financial objectives.

Determining Fixed Expenses

Fixed expenses are essential costs that remain the same each month. These expenses should be prioritized to ensure you have a stable financial foundation.

Allocating Variable Expenses

Variable expenses, on the other hand, can be adjusted based on your financial goals and priorities. By allocating your variable expenses effectively, you’ll be able to make the most of your money and achieve financial freedom.

Emergency Fund Planning

Emergency funds are crucial for covering unexpected expenses, such as car repairs or medical bills. By planning for emergency funds, you’ll be able to avoid debt and maintain financial stability.

Step-by-Step Implementation Guide

To effectively use the cash envelope system, start by setting up your envelopes and allocating funds. This step is crucial in how to use the cash envelope system as it helps you prioritize your spending. Begin by identifying your spending categories, such as groceries, entertainment, and transportation. Once you have your categories, assign a specific envelope to each one.

Next, determine how much money you will allocate to each envelope. This is where effective money management methods come into play. Consider your income and expenses to ensure you’re allocating enough funds to cover your necessary expenses. You can use the 50/30/20 rule as a guideline, where 50% of your income goes towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Here’s a simple, step-by-step process to get you started:

- Set up your envelopes and label them according to your spending categories

- Allocate funds to each envelope based on your budget

- Track your expenses by recording each purchase in the corresponding envelope

- Review and adjust your budget regularly to ensure you’re staying on track

By following these steps and using the cash envelope system, you’ll be well on your way to achieving effective money management methods and taking control of your finances. Remember to stay consistent and make adjustments as needed to ensure the system works best for you.

Common Challenges and Solutions

When using the envelope budgeting system, you may encounter some challenges. One common issue is dealing with online payments. Since the envelope system relies on physical cash, it can be difficult to manage online transactions. To overcome this, you can set aside a specific envelope for online expenses or use a digital tool to track your online spending.

Another challenge is managing large purchases. These can be difficult to fit into your envelope system, especially if you don’t have enough cash set aside. To handle large purchases, consider setting up a separate savings envelope or using a budgeting strategy that allows for occasional big-ticket items. Effective budgeting strategies for saving money can help you stay on track and make the most of your envelope system.

Dealing with Online Payments

Online payments can be tricky to manage with the envelope system. However, there are some envelope budgeting system tips that can help. For example, you can use a digital envelope system or set aside a specific amount of cash each month for online expenses. This will help you stay organized and ensure that you have enough money set aside for online transactions.

Managing Large Purchases

Large purchases can be challenging to fit into your envelope system. To manage these expenses, consider setting up a separate savings envelope or using a budgeting strategy that allows for occasional big-ticket items. This will help you stay on track and make the most of your envelope system. By using effective budgeting strategies for saving money and following envelope budgeting system tips, you can overcome common challenges and achieve your financial goals.

Digital Alternatives to Physical Envelopes

For those who prefer a more tech-savvy approach to managing their finances, there are several digital alternatives to the traditional cash envelope system. These options allow individuals to implement effective money management methods, such as how to use the cash envelope system, in a more modern and convenient way.

One of the most popular digital alternatives is the use of budgeting apps. These apps allow users to create virtual envelopes, track their spending, and set financial goals. Some popular budgeting apps include Mint, You Need a Budget (YNAB), and Personal Capital. These apps provide a range of features, including:

- Virtual envelope systems that mimic the traditional cash envelope system

- Automated transaction tracking and categorization

- Customizable budgeting and financial goal-setting

- Investment tracking and analysis

In addition to budgeting apps, there are also virtual envelope systems that can be used to manage finances. These systems allow users to create digital envelopes and allocate funds to specific categories, such as housing, transportation, and entertainment. Virtual envelope systems can be accessed online or through mobile apps, making it easy to manage finances on-the-go.

Overall, digital alternatives to physical envelopes provide a convenient and effective way to manage finances and implement the cash envelope system. By using budgeting apps and virtual envelope systems, individuals can take control of their finances and achieve their financial goals.

Success Stories and Real-Life Examples

Mastering your personal finances can have a significant impact on your life. By using effective budgeting strategies for saving money, individuals can achieve financial stability and security. Many people have successfully transformed their finances using the envelope system, and their stories are truly inspiring.

For instance, a family of four was able to pay off their debt and save for a down payment on a house by implementing the envelope system and sticking to their budget. They allocated their income into categories, such as housing, food, and entertainment, and used the envelope system to track their expenses. This approach helped them master their personal finances and make progress towards their financial goals.

Another example is a young professional who was able to save for a big purchase by using the envelope system to budget her expenses. She created a separate envelope for her savings goal and made sure to allocate a certain amount of money to it each month. By using this budgeting strategy, she was able to master her personal finances and achieve her goal in a relatively short period of time.

These success stories demonstrate the effectiveness of the envelope system in helping individuals master their personal finances and achieve their financial goals. By using budgeting strategies for saving money and sticking to their budgets, people can make significant progress towards financial stability and security.

Tips for Long-Term Success

Mastering the envelope budgeting system requires dedication and persistence. To achieve long-term success, it’s essential to build healthy money habits and stay motivated. Effective money management methods, such as the envelope system, can help you track your expenses and make conscious financial decisions.

By following envelope budgeting system tips, you can create a personalized budget that suits your needs and financial goals. This includes setting realistic targets, prioritizing expenses, and regularly reviewing your progress.

Building Healthy Money Habits

Developing healthy money habits is crucial for long-term financial success. This can be achieved by:

- Creating a budget and sticking to it

- Prioritizing needs over wants

- Building an emergency fund

Staying Motivated

To stay motivated, it’s essential to track your progress and celebrate small victories. This can be done by:

- Regularly reviewing your budget

- Setting achievable milestones

- Rewarding yourself for reaching financial goals

By following these tips and using effective money management methods, you can achieve long-term financial success and enjoy a more stable financial future.

Combining the Envelope System with Other Budgeting Methods

When it comes to managing your finances, using a combination of budgeting strategies for saving money can be highly effective. By Mastering your personal finances, you can create a comprehensive approach to financial management. The envelope system can be paired with other methods, such as the 50/30/20 rule or zero-based budgeting, to create a personalized plan that suits your unique financial situation.

Some people find that using a hybrid approach, combining the envelope system with digital budgeting tools, helps them stay on track. This can include using budgeting apps or spreadsheets to monitor expenses and stay organized. By finding the right combination of budgeting strategies for saving money, you can Master your personal finances and achieve your financial goals.

Here are some tips for combining the envelope system with other budgeting methods:

* Start by identifying your financial goals and priorities

* Choose a combination of budgeting strategies that work for you

* Monitor your progress and make adjustments as needed

* Consider using digital tools to supplement your envelope system

By taking a proactive approach to managing your finances and using a combination of budgeting strategies for saving money, you can Master your personal finances and achieve long-term financial success.

Conclusion

As you’ve discovered, the cash envelope system is a powerful tool for taking control of your finances and achieving your financial goals. By dividing your expenses into various categories and physically allocating cash to each, you can develop a heightened awareness of your spending habits and make more informed decisions about where your money is going.

The benefits of using the cash envelope system are numerous – from reduced impulse purchases to improved budgeting discipline and a better overall understanding of your money management methods. This system has helped countless individuals and families reach their financial milestones, from paying off debt to building up savings.

We encourage you to embrace the envelope system and make it a core part of your personal finance routine. With consistency, patience, and a commitment to sticking to your plan, you can transform your relationship with money and create a solid foundation for a financially secure future. Start small, experiment with different approaches, and don’t be afraid to adjust your strategies as your needs and circumstances evolve.

Remember, your journey to financial well-being is a marathon, not a sprint. Stay focused, celebrate your successes, and never lose sight of the power you hold to shape your financial destiny. The envelope system is your ally in this pursuit, guiding you towards a more effective money management and a brighter tomorrow.

FAQ

What is the envelope budgeting system?

The envelope budgeting system is a simple and effective way to manage your personal finances. It involves dividing your money into different envelopes, each representing a specific spending category, like groceries, entertainment, or transportation. This system helps you stay on track with your budgeting and avoid overspending.

What are the benefits of using the envelope budgeting system?

The envelope budgeting system offers several key benefits, including increased financial awareness, reduced overspending, and improved saving habits. By physically separating your cash into designated envelopes, you become more mindful of your spending and less likely to impulse buy or exceed your budget.

How do I set up my envelope system?

To set up your envelope system, you’ll need to determine your spending categories, allocate funds to each envelope based on your budget, and obtain the necessary supplies like envelopes, labels, and a cash-counting tool. We’ll provide detailed guidance on the step-by-step process to help you get started.

How do I handle online payments and large purchases with the envelope system?

The envelope system can be adapted to handle online payments and large purchases. You can designate a specific “online” or “big purchase” envelope to set aside funds for these expenses. We’ll share strategies for managing these types of transactions while still maintaining the core principles of the envelope budgeting method.

Can I use a digital alternative to physical envelopes?

Yes, there are several digital alternatives to the traditional physical envelope system, such as budgeting apps and virtual envelope systems. These options can provide the same benefits as the cash-based envelope method, with the added convenience of digital tracking and integration with your online financial accounts.

How can I stay motivated and successful with the envelope system long-term?

Maintaining long-term success with the envelope system requires building healthy money habits, staying motivated, and regularly tracking your progress. We’ll provide tips on how to incorporate the envelope system into your daily routine, celebrate your wins, and make adjustments as your financial situation evolves.